While I’m not a programmer or a specialist in software development, I’m fascinated by the opportunities blockchain technology brings. This innovation, combined with advancements in areas like AI, tokenization, and decentralized finance (DeFi), holds the potential to reshape how we think about businesses, ownership, and social interaction. To me, ‘crypto’ is more than just digital currencies – it’s part of a rapidly evolving ecosystem that encompasses decentralized technologies, new financial models, and digital ownership. From the foundational principles of blockchain to its applications in finance and beyond, there’s so much to learn and discover.

In this section, I’ll touch on key concepts like Web3, DeFi, and tokenization, sharing my thoughts and exploring how these ideas are shaping our digital future.

Web3

Web1, the first version of the internet, was a static network with simple web pages linked through hyperlinks. Users were mainly consumers of information with limited interaction possibilities, and creating content required advanced technical knowledge.

Web2, the current iteration of the internet, marked a significant revolution through the advent of social media and user-friendly platforms. It made it feasible for the average person to both consume and create content, embedding interaction as a core part of our online experience. However, this era is dominated by a few large technology companies, leading users to delegate substantial amounts of information and responsibility to these siloed third-party platforms. This has granted these centralized entities considerable power and influence over data and content ownership.

Web3 represents a decentralized vision of the Internet, aiming to fundamentally change how individuals and institutions form agreements. It seeks to merge the decentralized architecture of Web1 with the interactive and user-centric features of Web2. This combination aims to foster a digital ecosystem where data is owned by users, and transactions are secured by cryptographic guarantees. In Web3, trust in agreements is not based on brand reputations or paper promises but on blockchain and smart contracts that execute contracts precisely as programmed. This paradigm shift from trust-based to trustless systems represents a significant evolution in how online interactions and transactions are conducted.

Blockchain

A blockchain is a public, distributed ledger that securely and transparently records transactions across a decentralized network. Transactions are encrypted and compiled into blocks, which are chained together chronologically to create an immutable record. This technology supports various uses, including cryptocurrency transactions and smart contracts that automatically execute agreements when specific conditions are met.

Furthermore, blockchains can be leveraged to ensure the authenticity and traceability of goods in the supply chain, to provide individual ownership of digital assets through NFTs (non-fungible tokens), and to create decentralized applications (dApps) that operate without a central authority. With its ability to offer security, transparency, and resistance to censorship, blockchain has the potential to revolutionize how we conduct transactions, manage data, and construct digital systems.

Tokens

Tokens are digital assets that represent a unit of value, ownership, or rights on a blockchain. They are versatile tools within blockchain ecosystems, enabling the transfer of value, access to services, or even representation of shares in a project or community

Types of Tokens

- Utility Tokens: Used to access services or products within a specific platform, such as payment for services.

- Security Tokens: Represent an investment in an asset, like company shares, and are often regulated under financial laws.

- Stablecoins: Tokens pegged to stable assets (e.g., USD) to reduce price volatility.

- Governance Tokens: Allow holders to participate in decision-making processes for decentralized platforms or projects.

- Memecoins: Tokens created primarily as jokes or cultural references but can gain significant value and usage due to community interest.

Creation and Use of Tokens

Tokens are created through a process called tokenization, which involves representing assets or ideas on a blockchain. These tokens are widely used for trading, payments, voting, and accessing services within blockchain ecosystems. While some tokens represent tangible assets like real estate, many others (e.g., utility tokens or memecoins) exist purely in the digital realm, providing unique functionalities within their ecosystems.

NFTs

NFTs are unique digital assets that represent ownership of specific items or content, such as digital art, music, or collectibles. Unlike fungible tokens like Bitcoin, which are interchangeable, each NFT has unique properties and value.

Differences Between NFTs and Other Tokens

- Uniqueness: NFTs are one-of-a-kind and cannot be replaced by another token of equal value.

- Versatility: NFTs represent ownership of unique items or grant exclusive access, beyond payments or services.

Applications of NFTs

- Art and Collectibles: Represent and sell digital art or rare collectibles, empowering creators.

- Books, Music, and Film: Allow creators to distribute digital content with greater control over ownership and revenue.

- Gaming and Virtual Worlds: Enable ownership of in-game items, characters, or virtual land.

- Real Estate and Physical Assets: Simplify property transactions by representing ownership on the blockchain.

- Memberships and Access: Serve as membership tokens granting access to exclusive content or services.

- Event Tickets: Securely manage event tickets as NFTs, preventing fraud and simplifying transfers.

Metaverse

The Metaverse represents the next stage in internet evolution, merging Virtual Reality (VR) and Augmented Reality (AR) to blend physical and digital realms for immersive experiences. It introduces VR headsets for navigating virtual worlds, enhancing interaction and presence, and creates digital environments for activities in entertainment, education, and socializing.

As a continuously evolving concept, the Metaverse’s potential and applications are still being explored. Beyond gaming and socializing, it offers new ways for virtual work and collaboration, allowing for innovative forms of digital interaction and teamwork.

DeFi

DeFi – Decentralized Finance

DeFi is revolutionizing traditional financial systems by offering financial services on the blockchain, bypassing banks and other intermediaries. Built on smart contracts, DeFi enables loans, savings, trading, and insurance in a transparent and global ecosystem, empowering users with greater control over their assets.

Key Use Cases of DeFi

1. Lending and Borrowing

DeFi platforms allow users to lend their cryptocurrency to earn interest or borrow funds without needing a bank. These peer-to-peer systems are powered by smart contracts, eliminating intermediaries and reducing costs.

2. Decentralized Exchanges (DEXs)

DEXs let users trade tokens directly with each other without a central authority. Unlike traditional exchanges, DEXs are more transparent and give users full control over their assets.

3. Yield Farming

Yield farming enables users to earn passive income by locking their tokens into DeFi protocols. In return, they receive interest, rewards, or additional tokens.

4. DeFi Insurance

Blockchain-based insurance uses smart contracts to automatically pay claims when specific conditions are met. This eliminates the need for intermediaries and speeds up payouts.

5. Blockchain Oracles

Oracles connect DeFi platforms to real-world data, like weather information or asset prices, enabling smart contracts to function accurately. They ensure trust by verifying data from multiple sources.

6. Stablecoins

Stablecoins are cryptocurrencies pegged to stable assets like the US dollar or gold. They reduce volatility, providing a reliable option for transactions and as collateral in DeFi systems.

7. Asset Management

DeFi simplifies investing by offering tools for managing assets securely and transparently. Smart contracts enhance efficiency, making investments cheaper and faster.

8. Real World Assets (RWAs)

RWAs bring traditional assets like real estate, bonds, and commodities into the blockchain ecosystem. By tokenizing these assets, DeFi lowers entry barriers, enabling fractional ownership and increasing accessibility and liquidity for investors.

Example of advantages:

- Liquidity Enhancement

Tokenization transforms traditionally illiquid assets into more accessible investments, increasing liquidity and enabling faster transactions. - Fractional Ownership

Breaking down assets into tokenized shares lowers entry barriers, allowing more people to participate in investments. This democratizes access to high-value assets like real estate or collectibles. - Transparency and Verifiability

Blockchain’s inherent transparency ensures that every transaction and ownership record is securely stored and easily verifiable, building trust among participants. - Market Expansion and Inclusivity

Tokenized assets open up markets to a broader and more diverse group of investors, fostering financial inclusion and driving growth in the global economy.

Example of applications:

- Bonds

Tokenization enables fractional ownership of sovereign bonds, providing investors with access to secure assets and the opportunity to earn yields. - Real Estate

Property investment becomes more accessible through fractional ownership, allowing smaller investors to participate in real estate markets. Tokenization also enables diversification, letting investors spread their capital across multiple properties, markets, regions, or even countries. This reduces risk and provides exposure to a variety of opportunities, enhancing both stability and growth potential. - Commodities and Art

High-value assets like fine art, collectibles, and commodities are made available to a broader audience, enabling fractional investment and democratizing access. - Equipment and Machinery

Industrial assets, such as machinery and equipment, can be tokenized to allow fractional ownership and usage rights, increasing efficiency and optimizing utilization.

Overall, tokenization is transforming the financial landscape by making investments more accessible, transparent, and diversified. It bridges the gap between traditional assets and the innovative world of digital finance through DeFi, opening new opportunities for investors worldwide.

DAO

A Decentralized Autonomous Organization (DAO) operates through smart contracts on a blockchain, introducing a model for collective decision-making and resource management without centralized control. Rules and policies are encoded, ensuring transparency, automation, and resistance to manipulation.

DAOs are self-governing; members’ decisions directly influence the organization’s direction and resource allocation. Members typically hold voting rights through tokens representing a share in the organization, enabling a democratic and efficient decision-making process on matters like financial management and project development.

Leveraging blockchain technology, DAOs maintain high transparency and security. All transactions and decisions are recorded on the blockchain, allowing open audits and fostering trust among members and external parties.

DAOs have gained traction in various sectors, including decentralized finance (DeFi), charitable organizations, investment funds, and project management. They address traditional organizational challenges such as bureaucracy and lack of transparency, offering new avenues for collective ownership and governance.

IoT

The Internet of Things (IoT) connects physical objects to the internet, enabling them to collect, exchange, and act on data. This technology transforms ordinary items into “smart” devices, allowing them to interact with the world and other devices seamlessly.

IoT has applications across various industries, from smart homes and wearable technology to fitness equipment and even smart cities. In a smart home, devices like thermostats, lighting systems, and security cameras can communicate with each other and their users, improving convenience, energy efficiency, and safety.

For fitness, IoT-enabled workout gear and fitness trackers monitor performance, health metrics, and exercise routines in real-time. These devices provide personalized insights and guidance, helping users optimize their training and overall health outcomes.

Ai

Artificial Intelligence (AI) mimics human intelligence to perform tasks like decision-making, pattern recognition, and automation. By leveraging techniques such as machine learning and neural networks, AI transforms industries ranging from education to finance. Its ability to enhance efficiency, improve decision-making, and foster innovation positions AI as a key driver of technological advancement.

AI’s integration into Web3, blockchain, the Metaverse, DeFi, and DAOs demonstrates its potential to revolutionize these technologies by improving efficiency, security, and user experience.

Applications of AI in Emerging Technologies

AI Agents – Personalized Assistance

- AI agents are evolving to act as multi-functional assistants, integrating roles like a dietitian, personal trainer, or financial advisor into a single, cohesive companion. These agents leverage data, such as health metrics, exercise routines, and dietary preferences, to provide personalized recommendations. For example, an AI agent could create customized meal plans based on your goals and monitor your workouts, offering real-time adjustments and motivation. Over time, these agents learn and adapt, becoming even more effective at guiding you toward achieving your objectives.

Web3 and Blockchain

- Security Optimization: AI analyzes transaction patterns to detect and prevent fraud, enhancing network security.

- Smart Contract Management: AI automates and optimizes the execution of smart contracts, reducing manual oversight and improving efficiency.

Metaverse

- Personalized User Experiences: AI creates dynamic, tailored environments by learning from user behavior and preferences.

- Interactivity: AI-driven avatars and NPCs (Non-Player Characters) enable more engaging and interactive experiences in virtual spaces.

DeFi (Decentralized Finance)

- Risk Assessment: Real-time AI analysis helps users evaluate risks and make better investment decisions.

- Market Predictions: Machine learning identifies trends and forecasts market movements, aiding investors in navigating complex financial landscapes.

DAOs (Decentralized Autonomous Organizations)

- Decision-Making Support: AI provides data-driven insights to inform members’ decisions, enabling smarter governance.

- Task Automation: Routine tasks, such as financial management and voting processes, can be automated with AI, freeing up resources for strategic initiatives.

The Future of AI Integration

By integrating AI into Web3, blockchain, the Metaverse, DeFi, and DAOs, organizations can unlock new levels of efficiency, security, and user experience. This synergy between AI and decentralized technologies promises a future rich with innovation, where processes are streamlined and opportunities for value creation are limitless.

Understanding Centralized and Decentralized Exchanges

When venturing into the world of cryptocurrencies, you’ll likely encounter two main types of exchanges: Centralized Exchanges (CEX) and Decentralized Exchanges (DEX). Understanding the difference between these two can help you make informed decisions on your crypto journey.

Centralized Exchanges (CEX)

Centralized exchanges are managed by a specific company or organization, acting as intermediaries for trades. They offer a range of services, including buying, selling, and sometimes storing cryptocurrencies. For many newcomers, CEXs serve as an easy “on-ramp” to purchase cryptocurrencies using traditional fiat money like dollars or euros. Notable examples include Coinbase, Binance, and Kraken.

Advantages of CEXs:

- User-Friendly: CEXs provide intuitive interfaces and customer support, making them accessible to beginners.

- Liquidity: Centralized management ensures high liquidity for smoother trading.

Considerations:

- Trust Required: Users must rely on the exchange’s security measures and typically surrender control of their private keys.

Decentralized Exchanges (DEX)

In contrast, decentralized exchanges operate without a central authority. Trades occur directly between users (peer-to-peer) through automated smart contracts. This decentralized structure enhances privacy and eliminates a single point of failure, reducing security risks. Popular examples include Uniswap and SushiSwap, along with Cardano-based DEXs like Minswap, WingRiders, and SundaeSwap.

Advantages of DEXs:

- User Control: DEXs allow users to retain full control over their private keys, providing greater autonomy.

- Privacy: Transactions are conducted without requiring personal information, preserving anonymity.

Considerations:

- Complexity: DEXs can be less intuitive for beginners.

- Liquidity: They may lack the same level of liquidity and variety of assets as CEXs.

To start trading crypto easily – Join KuCoin today!

Comparison of CEXs and DEXs

| Feature | Centralized Exchanges (CEXs) | Decentralized Exchanges (DEXs) |

|---|---|---|

| Control | Platform-controlled funds | User-controlled funds |

| Ease of Use | Beginner-friendly | Advanced users |

| Security | Vulnerable to hacks | Less centralized risks |

| Liquidity | High liquidity | Lower liquidity |

| Anonymity | Requires user verification | Allows anonymous trading |

Wallets

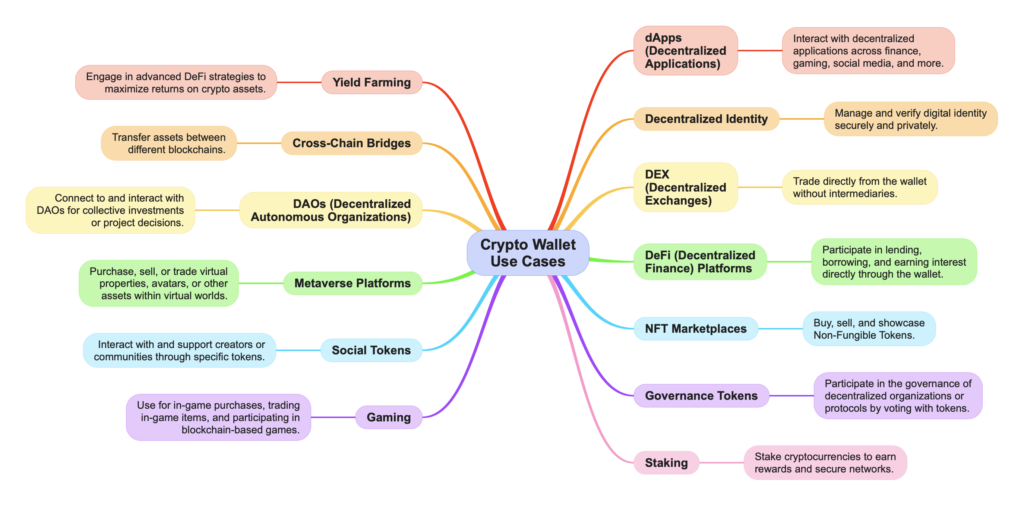

Understanding Crypto Wallets

A crypto wallet is a tool that allows you to interact with a blockchain network. It enables you to send and receive cryptocurrencies, store digital assets, and access decentralized applications (DApps).

Unlike a traditional wallet that holds physical money, a crypto wallet doesn’t store currency directly. Instead, it secures the digital “keys” needed to interact with the blockchain:

- Private Keys: These are like your password and must be kept secret. They grant access to your assets and allow you to authorize transactions.

- Public Keys: These are like your account number and can be shared with others to receive payments or assets.

Without your private keys, you cannot access your funds, emphasizing the importance of securely storing them.

Self-Custodial Wallets

Self-custodial wallets grant users full control over their private keys and cryptocurrency assets. Without intermediaries, you can trade crypto and interact directly with the blockchain, making self-custodial wallets essential for using decentralized exchanges (DEXs) or decentralized applications (DApps).

Advantages:

- Control: Full ownership of your assets.

- Privacy: No third-party involvement in transactions.

- Freedom: Direct access to blockchain ecosystems.

Disadvantages:

- Responsibility: You are solely responsible for securing your wallet.

The Importance of Safeguarding Your Seed Phrase

A seed phrase is a unique recovery code for your wallet and the only way to restore access if you lose your private keys. Unlike a traditional bank or centralized exchange, there is no backup or support if your seed phrase is lost.

Key Considerations:

- Secure Storage: Keep your seed phrase offline, in a safe location. Avoid storing it digitally where it could be hacked.

- No Sharing: Never share your seed phrase with anyone. Anyone with access to it can take control of your wallet and assets.

- Redundancy: Consider creating multiple physical copies and storing them in different secure locations.

Self-custodial wallets provide unparalleled control and freedom but come with the significant responsibility of securing your assets. Ensuring the safety of your seed phrase is paramount to protecting your digital wealth.

Custodial Wallets

Custodial wallets are a type of crypto wallet where a third party, such as a cryptocurrency exchange, holds and manages your private keys. This means the third party has control over your wallet’s transactions and security.

How They Work:

Users access their funds through the provider’s app or web interface, relying on the provider’s security measures and infrastructure to safeguard their assets. This setup is similar to a traditional bank account, where the institution manages and protects your funds.

Advantages:

- Convenience: Easy to use, especially for beginners.

- Accessibility: No need to manage private keys directly.

- Support: Customer service and recovery options are available in case of lost login credentials.

Disadvantages:

- Trust Required: You must trust the provider to keep your funds secure.

- No Full Ownership: You do not have direct control over your private keys, meaning your assets are not entirely in your hands.

Custodial wallets offer a user-friendly experience and are often the first choice for newcomers to cryptocurrency. However, they come with the trade-off of relying on a third party for security and control.

Hardware wallets – The Gold Standard for Security

Hardware wallets are electronic devices designed to provide an extra layer of security for your digital assets. Unlike software wallets, which operate on your computer or mobile device, hardware wallets store private keys on a physical device, keeping them isolated from online vulnerabilities and cyber threats.

Because they remain offline (often referred to as “cold wallets”), hardware wallets are immune to online hacking attempts, making them one of the safest methods for storing cryptocurrency.

How They Work

One of the defining features of hardware wallets is the requirement for physical confirmation of transactions. This dual-confirmation process means that:

- Transactions must be initiated through a software wallet.

- You must manually approve the transaction on the hardware wallet itself.

This process significantly enhances security, ensuring that no transaction can occur without your explicit consent through physical interaction with the device.

Advantages and Considerations

Advantages:

- Unmatched Security: Immune to online hacks, thanks to offline storage.

- Physical Authorization: Prevents unauthorized transactions.

- Peace of Mind: Offers robust protection for long-term storage of digital assets.

Considerations:

- Cost: Hardware wallets come at a price, which may be a barrier for some users.

- Ease of Use: Slightly less convenient compared to software wallets, especially for frequent transactions.

Terminology: Cold Wallets vs. Hot Wallets

- Hardware Wallet (Cold Wallet): Offline and highly secure, ideal for long-term storage.

- Software Wallet (Hot Wallet): Online and convenient, better suited for frequent transactions but more vulnerable to cyber threats.

Hardware wallets may require an upfront investment and a small learning curve, but for those serious about protecting their digital assets, the security they provide is invaluable.

Taxes

Due to the blockchain’s transparent and immutable nature, reporting cryptocurrency transactions has become a straightforward task, especially with the help of modern crypto tax software. If you’ve made gains or losses through trading, staking, or other activities, these tools simplify the entire process by:

- Automating Data Import: Seamlessly syncing with wallets and exchanges to collect transaction data.

- Accurate Calculations: Effortlessly calculating profits, losses, and income from various crypto activities.

- Generating Reports: Creating clear and concise tax documents tailored to your needs, ready for filing.

Where Fitness Meets Web3

Exploring the world of crypto and tackling everyday challenges requires focus and mental clarity. Daily workouts aren’t just about staying active – they’re a way to nurture both body and mind, helping you stay sharp and balanced.

Now that you’ve been introduced to NFTs and Web3, this is an opportunity to gently step into a space where fitness, technology, and community come together. Our platform is just beginning its journey into this innovative world, and we’re excited to grow and evolve alongside you.

Join us as we take small but meaningful steps toward a future where health and technology connect in new and inspiring ways. Together, we’ll explore what’s possible.